In today’s challenging retail environment, where consumer needs are rapidly evolving and promotional activity is intensifying, both established leaders and challenger brands are under pressure to find sustainable paths to growth.

But while the market may be competitive, it isn’t binary.

The most valuable lesson in 2025?

Brands, big or small, stand to gain more by learning from each other than by going it alone, writes Rachel White, MD UK&I at NielsenIQ.

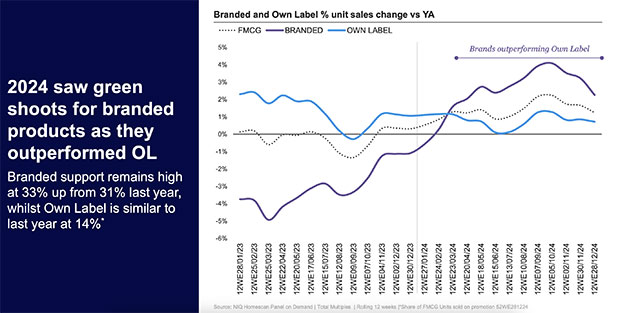

UK grocery value sales hit £14.6bn in the four weeks to December 28, 2024, according to NIQ Total Till data. That rebound was driven in part by record promotional intensity: 37% of branded FMCG sales were sold on promotion, the highest level in three years. At the same time, volume sales returned to positive growth (+0.5%), showing that shoppers are still willing to spend, but they’re more discerning, selective, and demanding than ever.

Speed vs scale: The innovation trade-off

NIQ’s recent State of the Nation (SOTN) report 2025 shows that challenger brands, i.e. all branded players outside the top four by supercategory, grew unit sales faster than category leaders in 2024, even when priced at a premium. Brands like Byoma and Tony’s Chocolonely have captured consumer attention through authenticity, purpose, and a clear point of difference not necessarily discounting.

This agility allows challengers to move in step with changing cultural trends and test new formats or channels more freely, including social commerce and direct-to-consumer initiatives. It’s a flexibility that many larger players are striving to build into their structures – but it takes deliberate effort.

On the other hand, scale has its own strengths. Leading brands typically excel at retailer partnerships, loyalty integration and omnichannel distribution, all of which are essential for growth in a fragmented market. The data also shows that UK brands which grew household penetration were twice as likely to see volume growth than those that relied on frequency alone. That’s a critical insight for challenger brands hoping to grow without losing their identity: reach matters, and delivering it sustainably requires infrastructure, consistency, and distribution.

Consumer outlook on private labels and brands

NIQ’s SOTN data indicates steady growth awaits both private label and branded products. Improving consumer sentiment, such as “I am open to buying different brands, even if they are not on promotion,” is up 2 percentage points on household products (41%) on last year. And 53% of global consumers say they’re likely buying more private label products than ever before.

Private label products have closed the gap in consumer perceptions of quality and bolstered consumers’ view of their value proposition. The stigma has faded. 68% of global consumers say private labels are good alternatives to name brands.

Retailers must continuously innovate to maintain strong private label growth, globally and across regions. Though private labels’ share of sales has risen by 1.4 points globally, retailers will need to think differently to avoid deceleration of growth. Retailers must continue to pump the pedals of innovation to maintain and exceed consumers’ expectations.

From competition to collaboration

Evidence is starting to mount that in order for every player to win a little, the reins of control must shift in favour of collaboration. No one will win a race to the bottom, so it becomes important for retailers and manufacturers to work together to grow and not further divide the size of the prize with consumers. This starts with understanding the drivers of consumer behaviour that are causing these brand performance shifts. In the corporate world, reverse mentoring has emerged as a valuable way for senior leaders to learn from younger employees. It challenges power dynamics and promotes mutual understanding.

A similar principle can apply in FMCG. Challenger brands, with their sharper focus on values and community, have much to teach established players. And leaders, with their operational experience and long-term customer strategies, have plenty to offer in return.

Together, these cross-pollinations can spark innovation, improve margin, and help brands of all sizes weather economic shifts and consumer unpredictability.

All ships rise with the tide

The road to mutual success between private-label and branded products can be a smooth journey, but only if both parties show up and commit. Large and small players will surprise themselves with the solutions they uncover under a spirit of collaboration versus competition. The secret is simply sitting down and listening to each other.

Comments are closed.