- Total Till sales growth in the last four weeks ending 3rd October increase from 5.6% to 8.3%

- Government guidelines in September asked Brits to return to working from home, as the temporary ‘Eat out to Help out’ scheme ended, leading shoppers to resume a now familiar WFH habit

- However, this time customers are not rushing to supermarkets, and there aren’t any signs of a return to levels of panic buying that occurred earlier in the year

Following the end of the temporary ‘Eat out to help out scheme’, and recent guidelines from the UK government that Brits should return to ‘work from home’ in September, UK shoppers have responded by spending more on their grocery shopping, as sales growth in the four weeks ending 3rd October hit 8.3%, reveals new data released today by Nielsen.

Following the end of the temporary ‘Eat out to help out scheme’, and recent guidelines from the UK government that Brits should return to ‘work from home’ in September, UK shoppers have responded by spending more on their grocery shopping, as sales growth in the four weeks ending 3rd October hit 8.3%, reveals new data released today by Nielsen.

In the four week period ending 3rd October 2020, Nielsen data reveals that beers, wines and spirits (+17%) remain the fastest growing category, followed by frozen (+16%). Whilst there has been a significant rise in sales of disinfectants (+92%), toilet tissue (+34%) and household cleaning accessories (+24%), these growths are far below the levels seen during the peak of the pandemic, and do not suggest the return of panic buying just yet¹.

Shoppers are continuing to move towards online shopping, with online FMCG growth up by 91% in the last four weeks as supermarkets continue to add additional delivery slots. Nielsen data also shows that in the last 12 weeks, 10.6m² shoppers used online to do their grocery shop – up from 7.2m at the same time last year. Whilst this has compromised store visits – down 11% in the last four weeks compared to this time last year – they are up from the low point of April. Spend per visit at stores was up 15%.

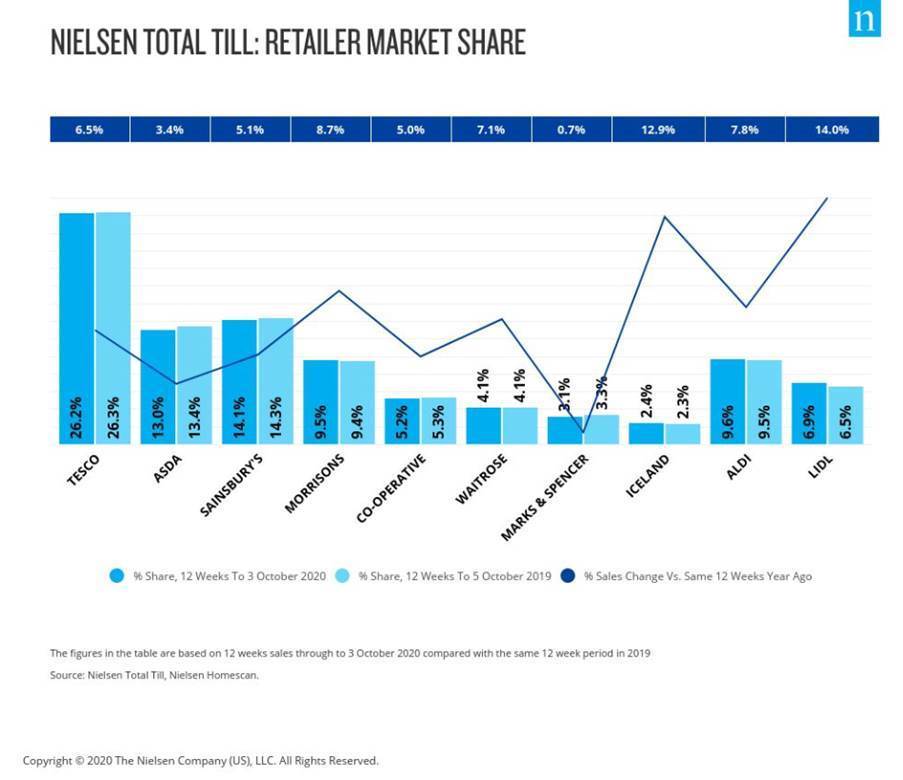

In terms of retailer performance over the last 12 weeks ending 3rd October 2020, Morrisons (+8.7%) remains the top performer of the ‘big four’ supermarkets. However, Ocado is still the fastest growing retailer with FMCG sales up +46% In the last 12 weeks. There was also strong growth from Lidl (+14%), which now overtakes Iceland (+12.9%). This is likely a result of Lidl launching its new loyalty app at the beginning of the month, offering shoppers multiple savings and adding momentum to its sales.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “Since March, households in the UK have had to continually adjust to new ways of working, living and eating. This is reflected in the volatility of weekly FMCG sales. Yet, after many months of living with the pandemic, some shoppers are getting more accustomed to this ‘new normal’ and there hasn’t been any strong signs of stockpiling like we had earlier in the year.”

Watkins concludes: “Whilst shoppers are slowly becoming more comfortable returning to stores, online remains the biggest winner and a third of shoppers who shopped online in the last 12 weeks are new to online. Shoppers who first shopped online in the early summer are staying online and making repeat purchases. Which means online is likely to take an even bigger share of sales as we head into the festive period, and we expect it to hit around 15% of all FMCG sales over the next few months.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

The figures in the table are based on 12 week sales through to 03 October 2020 compared with the same 12 week period in 2019

Source: Nielsen Total Till, Nielsen Homescan

Comments are closed.