- Total Till sales bounce back to +1.1% for the four weeks ending 14th August 2021, up from -1.3% in July, as short summer heatwave in the week ending 24th July helps lift grocery sales

- UK supermarkets experience 50 million more in-store visits over the last four weeks, compared with the same period in 2020

- Despite the decline in online grocery, it remains a popular channel for consumers, with UK shoppers spending a total of £1.1bn on their online grocery shop every four weeks

UK supermarkets experienced 50 million more in-store visits in the last four weeks ending 14th August 2021 compared with the same period last year, with store sales rising to £7.7bn. However, this is at the expense of online grocery sales, which have fallen by 10% compared to a year ago, reaching £1.1bn in sales, reveals new data released today by NielsenIQ.

NielsenIQ data reveals that despite this decline in online grocery sales as a result of the easing of restrictions, online still remains a popular channel with UK shoppers, who are still spending a total of £1.1bn1 on their online grocery shop every four weeks compared with £1.2b this time last year. Online share of grocery spend has declined to 12.7% but this is still close to the 13.4% in May 2020 during the height of the first lockdown. In contrast, visits to stores are up 12% and this shift back to stores suggests improving shopper confidence following the growth in vaccination rates, with shoppers more willing to shop more often and at more retailers, as well as the easing of social distancing restrictions in recent weeks, and a boost from summer weather.

This is reflected in the Total Till grocery sales figures, which rose by +1.1% in the last four weeks ending 14th August 2021, partly helped by a short heatwave in the week ending 24th July when sales peaked at +6.2%2. This was the most upbeat weekly sales since the Easter period and is a reminder of how weather can move the dial on shopper spend.

NielsenIQ data shows that confectionery (+9.6%) and soft drinks (+5.5%) categories experienced healthy growth, as consumers sought to purchase items for socialising and enjoying the tail end of the summer of sport, which included celebrating the Olympics, and holidays in the UK. As well as this, convenience foods such as delicatessen (+9.5%) and bakery (+8.1%) also experienced an uplift. However, frozen food (-4%) and beers, wines and spirits (-6%) saw sales decline, but this is due to having exceptional double-digit comparatives during the same period last year.

With ‘back to school’ becoming a reality this year for many families, sales in related items have helped supermarkets boost sales within the ‘general merchandise’ category, which have risen by +7.5% with clothing sales up an impressive 16%.

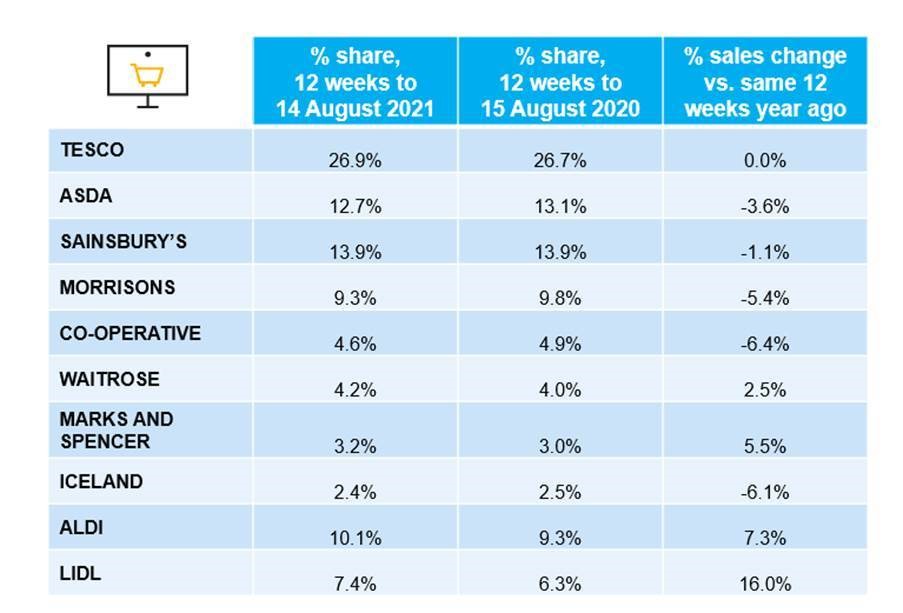

In terms of retailer performance, Lidl (16%) and Aldi (7.3%) led the market in terms of growth in the last 12 weeks and Marks & Spencer (5.5%) continued to experience good growth, helped by increased summer footfall and spend at its food halls in particular over the last four weeks.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “Shoppers seem more confident in visiting stores, which has had an impact on online grocery. However, the decline in online sales was expected as it is largely due to shoppers no longer needing to make such large shops as lifestyles finally started to normalise. What is important is that despite there being a lack of new online shoppers over the last 12 weeks, existing online shoppers are staying – just spending differently.”

Watkins concludes: “Food retail sales have been helped by events and warm weather in recent weeks but with the summer holidays soon coming to an end, retailers will need to keep their fingers crossed for an improving consumer sentiment to drive spending, particularly as we head into Q4, which could be a more challenging period with equally high comparatives.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Source: NielsenIQ Total Till, NielsenIQ Homescan.

Comments are closed.