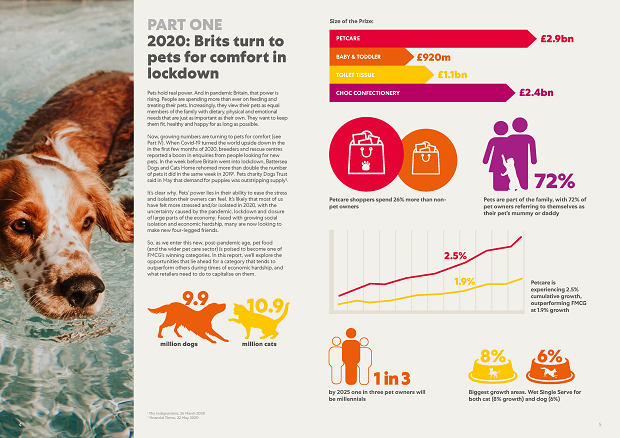

Britain’s cats and dogs have emerged from lockdown licking their lips as pet food sales boom, the first annual petcare market report, released by market leader Mars Petcare, reveals.

Traditionally playing a small but crucial role in pet food, convenience retailers have seen sales grow 3.1%[1], nearly twice the rate of the total UK grocery market over the last 12 month period.

Traditionally playing a small but crucial role in pet food, convenience retailers have seen sales grow 3.1%[1], nearly twice the rate of the total UK grocery market over the last 12 month period.

Across the board, treats value sales surged year on year from the week of the UK’s first Covid-19 case in February to the partial lifting of lockdown 12 weeks later; Dreamies saw an astonishing 12.9% growth whilst Pedigree grew an equally impressive 11.8%[2] as treating occasions rose 12% in the weeks following lockdown on 23rd March[3].

“The pet treats boom shows the crucial role pets play in providing companionship, particularly in times of stress,” says Nick Foster, Category and Marketing Director; Mars Petcare UK.

“The last few months have been challenging for everyone, so it makes sense that many have sought to ease the strain by treating their pets as they were forced to stay inside. Treating is a way of strengthening the bond we have with our pets, rewarding good behaviour and looking after their health needs. It also gives us a powerful emotional reward.”

For the convenience market, the ‘little and often’ pattern of behaviour from shoppers was helping to drive growth before Covid-19 hit. Lockdown altered this, with people making less frequent visits to buy groceries and spending more during shopping trips. As many actively avoided larger store formats, local convenience stores have benefitted as shoppers stocked up on essentials for themselves and their pets.

“We know that convenience retailers have faced difficult times during the pandemic and have worked tirelessly to keep their local communities fed and provided for. If there is a silver lining for the channel it’s that there are now new growth opportunities in categories such as petcare, something we want to help retailers make the most of.” says Foster.

Pet treat purchases are much less planned than other areas of petcare, with 44% of sales being made on impulse[4]. Convenience retailers are perfectly placed to capitalise on this through agility and flexibility when it comes to displays, as secondary siting, brand blocking and clear segmentation can pay off, helping to increase basket spend further.

Foster continues: “The significant growth of the category shows just how expandable the pet treats market is. With one in three owners only ever treating their pets with functional products like dental chews, this boom in treating represents a significant opportunity for retailers.

“By encouraging pet owners to buy a wider repertoire of treats for a greater number of uses – such as to show love, reward, train or address health issues – we can drive more growth.”

The omens are good for further growth after breeders and pet homes reported huge demand for cats and dogs as Brits sought to ease the isolation of lockdown with new pets.

“Employers are becoming more amenable to staff working from home, making it easier for people to get the pet they’ve always dreamed of,” says Foster, adding that Mars Petcare is now forecasting compound annual growth of 2.4% over the next five years.

“This is another reason why the future is bright for the pet food and treats category.”

For more information on the future of pet food, see Mars Petcare’s report, The Rising Power of Pets in Pandemic Britain.

[1] Nielsen MAT 12 w/e 16 May

[2] Nielsen 12 w/e 16 May

[3] Mars Pet Engine for Growth panel (PEGGY)

[4] Nielsen Path to Purchase study 2015

Comments are closed.