- Over half (51%) of UK convenience retailers are concerned that the current cost-of-living crisis may increase the consumption of cheap, illicit cigarettes in 2023[i]

- 4 in 10 UK retailers believe greater access to, and awareness of, affordable smoke-free alternatives – such as e-cigarettes and heat-not-burn products – could reduce any potential increase in the consumption of illicit cigarettes this year[ii]

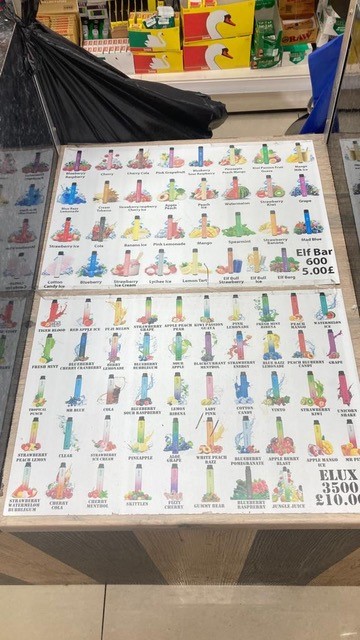

- Will O’Reilly, former Detective Chief Inspector at Scotland Yard, and illicit tobacco consultant for PML, says the illicit market for tobacco and nicotine-containing products has ‘evolved rapidly’ to include illicit disposable vaping devices

Survey data from KAM on behalf of Philip Morris Limited (PML), has revealed the growing concern among convenience retailers have that the current cost-of-living crisis will fuel a rise in the consumption of cheap, illicit cigarettes in the UK in 2023.

Survey data from KAM on behalf of Philip Morris Limited (PML), has revealed the growing concern among convenience retailers have that the current cost-of-living crisis will fuel a rise in the consumption of cheap, illicit cigarettes in the UK in 2023.

PML asked 250 UK convenience retailers a series of questions on what trends may emerge in the tobacco and smoke-free categories in 2023. On the issue of illicit tobacco, over half (51%) of responding convenience stores said they felt concerned that the current economic climate will increase the consumption of cheap, illicit cigarettes this year[iii].

PML asked 250 UK convenience retailers a series of questions on what trends may emerge in the tobacco and smoke-free categories in 2023. On the issue of illicit tobacco, over half (51%) of responding convenience stores said they felt concerned that the current economic climate will increase the consumption of cheap, illicit cigarettes this year[iii].

When asked if greater access to, and awareness of, affordable smoke-free alternatives would help reduce any potential increase in the consumption of illicit cigarettes, 4 in 10 UK retailers said that it would[iv]. In response to the rising cost-of-living, 46% of retailers also plan on expanding their smoke-free product range to offer adult smokers more affordable alternatives, such as e-cigarettes, heat-not-burn products, and nicotine pouches[v].

Figures released last year in a report by KPMG, and commissioned by Philip Morris International (PMI), found close to one-in-five cigarettes consumed in the UK in 2021 were illicit[vi] – up to almost one-in-three in some areas, such as the North East of England[vii]. This increase was fuelled by counterfeit cigarettes, growing 34.1% in 2021, meaning they are now the most prevalent form of illicit cigarette in the UK[viii].

Will O’Reilly, a former Detective Chief Inspector at Scotland Yard and a consultant on the illicit trade of tobacco and other nicotine products for PML, said: “The concerns of UK convenience retailers on the potential increase in illicit tobacco consumption are certainly justified, given the current cost-of-living crisis and the fact that criminal networks have a history of exploiting financial vulnerability.”

O’Reilly added: “In recent years, the black market has evolved rapidly – moving beyond tobacco to include other nicotine-containing products, particularly illegal disposable vaping devices. This is another key concern for those retailers operating on the right side of the law and committed to giving their adult customers access to quality, compliant and trust-worthy smoke-free alternatives.”

Kate O’Dowd, Head of Commercial Planning at PML in the UK and Ireland, has offered advice to retailers who may be concerned at any potential increase in the rise of illicit tobacco and nicotine-containing products in the UK. She said:

“Dealing directly with legitimate manufacturers with a solid track-record in the responsible commercialisation of smoke-free products would be my advice to retailers concerned at the proliferation of illicit tobacco and nicotine-containing products in the UK.

“PMI has invested USD 10.5 billion in the research and development of science-based, smoke-free products[ix] and apply scientific methods – inspired by the pharmaceutical industry – to ensure every product adheres to the highest manufacturing standards and strict quality control measures. This approach extends to our expanding multi-category portfolio of smoke-free products in the UK, which includes IQOS – the UK’s number one heat-not-burn product[x] – and VEEBA, a premium and recyclable disposable e-vapour device that strives for excellence in design, quality, and compliance.”

[i] PML 2023 research. Respondents: telephone interviews with 250 UK convenience retailers Fieldwork dates: 17th November to 1st December 2022. KAM

[ii] Ibid

[iii] Ibid

[iv] Ibid

[v] Ibid

[vi] KPMG Report: Illicit cigarette consumption in the EU, UK, Norway and Switzerland (2021 results)

[vii] Ibid

[viii] Ibid

[ix] Philip Morris International (PMI) fourth-quarter and full-year financial results for 2022 (pub February 9, 2023)

[x] As of December 2022, IQOS – Philip Morris International’s heated tobacco system – had a value share of the Heat not Burn segment in the UK of 99.42%, meaning IQOS was the UK’s number one product in that category, encompassing all devices and consumables. (Nielsen data)

Comments are closed.